CLI Newsletter December,2025

MARKET INSIGHT

Emerging Trends in Real Estate 2026

Presented by: PWC (chapter continue)

Chapter 1: Navigating the Fog

The 2026 real estate market is increasingly described by industry leaders as operating within a persistent “fog”—a haze created by economic uncertainty, shifting policies, and demographic pressures that makes forecasting more difficult than in past cycles. Although interest-rate-driven repricing is finally easing, visibility remains clouded by sticky inflation, tariff-related cost pressures, and restrictive immigration policies that not only tighten labor supply but also dampen future demand. Within this fog, sentiment varies: some view today’s volatility as temporary and expect fundamentals to brighten as rate cuts arrive, while others see disruptions as uneven and manageable, requiring only selective adjustments. A more cautious subset believes the environment reflects heavier fog—one characterized by higher-for-longer rates and weakening demand that demands more defensive, asset-level underwriting.

Despite these blurred conditions, the industry’s primary concerns remain consistent: interest rates, inflation, immigration policy, labor shortages, and rising operating costs. Yet optimism persists. Notably, the 2026 “Buy Rating” is the highest in 20 years, signaling widespread confidence that even in a foggy market, uncertainty can create meaningful opportunity for those positioning thoughtfully.

Part 1 highlights five major trends shaping strategy in 2026 and beyond:

1)Capital markets diverge—some see abundant liquidity ahead; others expect muted activity.

2)Niche is now essential—data centers, senior housing, medical office, and self-storage move into the mainstream.

3)Back to basics—asset quality, operations, and micro-location become key differentiators.

4)Demographics drive demand—aging populations and reduced immigration reshape growth patterns.

5)AI enters operations—from leasing chatbots to predictive maintenance, adoption accelerates.

Despite the fog, the industry sees opportunity. Success in 2026 will depend on disciplined asset selection, strong operations, and understanding how policy, demographics, and technology are reshaping demand.

Chapter 2: Property Type Outlook

Senior Housing

Senior housing is moving into a sustained national upswing driven by years of underbuilding and the rapid aging of the boomer generation. As more Americans approach age 80, transitions into rentals, active-adult, IL-lite, and assisted-living formats accelerate, tightening occupancy across the country. Construction remains constrained by high costs and labor shortages, limiting the pace of new supply. Investors continue favoring the sector for its essential-services model, growing middle-market demand, and long-term demographic clarity, all of which support durable performance.

Data Centers

Data centers remain the highest-rated U.S. real estate sector, powered by AI growth, cloud expansion, and corporate digitalization. National vacancy remains extremely low as power, land, and interconnection constraints restrict the ability to add new capacity. Despite development risks—including long grid timelines, water needs, and rapid chip innovation—the sector’s role as critical digital infrastructure draws increasing capital from private equity, infrastructure funds, and hyperscalers. Demand momentum remains strong as AI workloads expand and supply stays structurally limited.

Multifamily

The U.S. multifamily sector faces temporary pressure from a surge of recent deliveries, yet construction starts have fallen sharply, setting up a tighter environment after 2026. High mortgage rates and the homeowner lock-in effect continue pushing households toward renting, while inflation, tariffs, and insurance costs challenge operators. Newer buildings with strong amenities outperform older stock, which now requires targeted upgrades. With record numbers of young adults still living with family, significant pent-up household formation is expected to support long-term rental strength.

Industrial & Logistics

Industrial demand remains stable nationwide, anchored by domestic consumption and expanding e-commerce penetration. Manufacturing leasing continues rising due to reshoring trends, adding support to warehouse and production-related spaces. However, construction and financing costs have pushed many developments out of feasibility, causing starts and big-box projects to fall sharply. As deliveries slow, the U.S. is likely to face shortages of modern, high-clear-height inventory. Long-term fundamentals remain favorable as demand outpaces the reduced supply pipeline.

Medical Office

Medical office assets continue to perform well thanks to steady outpatient migration, aging demographics, and limited new construction. Healthcare systems increasingly rely on decentralized outpatient facilities, boosting occupancy and rent stability for MOBs. Investors value the sector’s long leases, essential-service positioning, and consistent demand patterns—features that differentiate it from traditional office. With demographic pressure building and supply constrained, MOBs remain a reliable, defensive component of diversified portfolios.

Student Housing

Student housing maintains strong national momentum, supported by high occupancy, solid rent growth, and declining construction pipelines. Tight supply conditions particularly benefit major research and public universities, where demand continues to exceed available beds. Although long-term demographic trends forecast fewer high-school graduates, leading institutions with strong reputations and international interest remain resilient. In the near term, slower development and steady enrollment are expected to keep leasing conditions competitive.

Office

The U.S. office sector continues its lengthy adjustment, with CBD values deeply discounted and absorption remaining negative. Tenants increasingly prioritize high-quality, amenitized buildings, leaving older and undifferentiated properties at risk of obsolescence. Suburban markets with favorable access, lower operating costs, and strong residential bases often outperform CBD towers. While a broad recovery will take time, selective opportunities exist in modern, well-located assets and distressed properties trading far below replacement cost.

IN THE NEWS

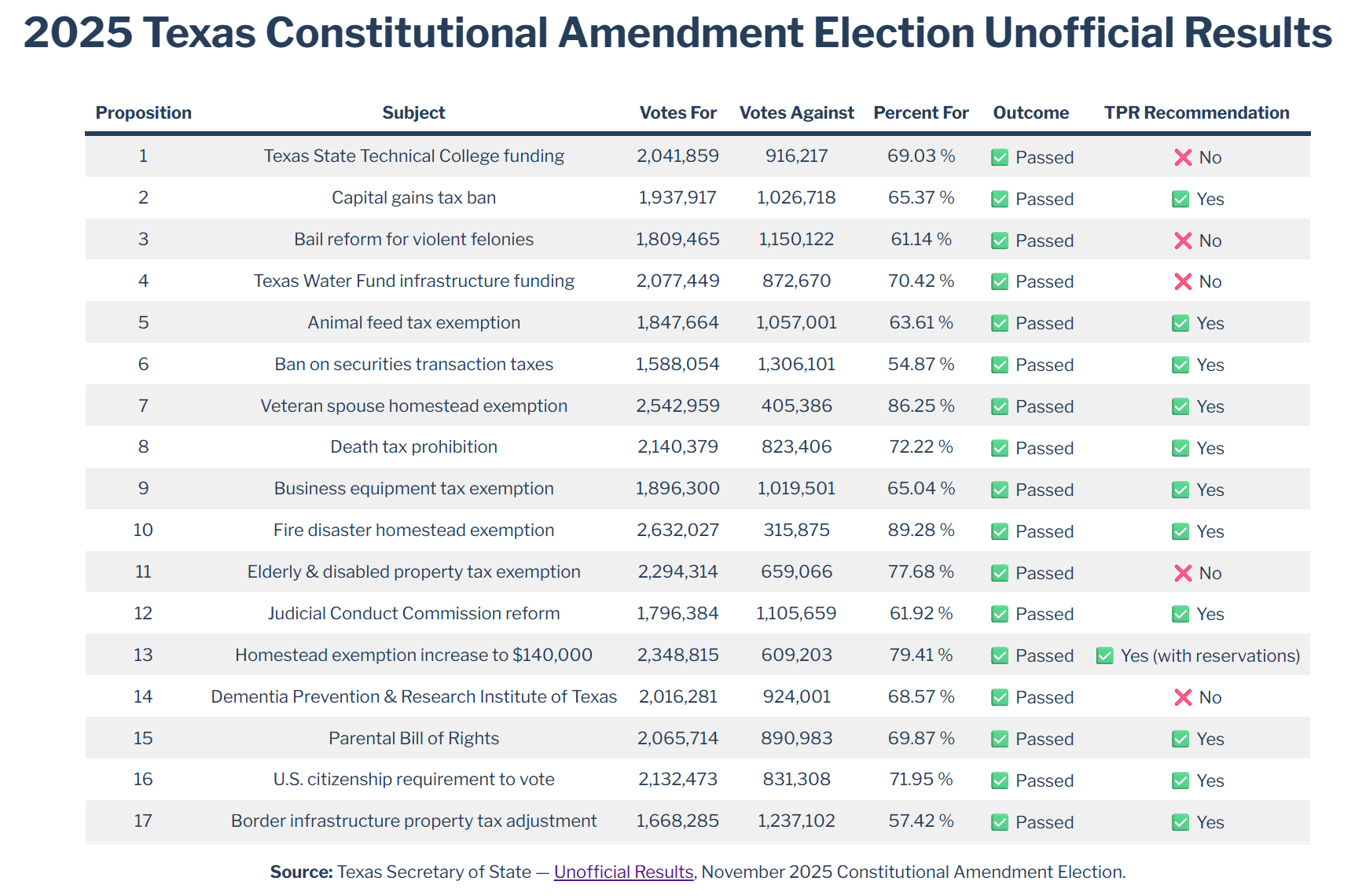

All 17 Texas Constitutional Amendments Pass in 2025 Election

Presented by The Texas Tribune

In the November 2025 statewide election, Texas voters approved all 17 proposed constitutional amendments, reshaping the state’s tax landscape, public-investment strategy, and regulatory environment. While the measures span education, public health, infrastructure, and governance, several amendments stand out for their direct positive impact on real estate owners, landlords, and long-term investors.

1. Significant Tax Relief for Homeowners and Property Holders

Several amendments expand or protect tax exemptions that directly lower the cost of owning property in Texas:

• Expanded Homestead Exemptions (Propositions 11 & 13)

Texas raised the homestead exemption for public-school taxes—

From $100,000 to $140,000 for all homeowners,

From $10,000 to $60,000 for seniors (65+) and disabled homeowners.

2. Strong Protection for Capital and Investment (Propositions 2, 6 & 8)

Texans voted to ban future state taxes on:

Realized or unrealized capital gains

Securities transactions (such as stock trades)

Estate, inheritance, and gift transfers

3. Property-Tax Protections for Special Circumstances (Propositions 7 & 10)

• Provides full or partial property-tax exemptions for surviving spouses of disabled or deceased veterans.

• Grants temporary property-tax exemptions for homes destroyed by fire, covering the value of the home (not land).

EVENT UPDATE

The year-end investor networking event closed on an exceptionally high note, uniting a dynamic group of industry professionals and thought leaders. Kevin Chen provided a forward-looking overview of the 2026 domestic and international economic landscape, giving attendees valuable perspectives to navigate the year ahead.

We were also honored to hear from Matthew Tempel, Director of Investment at NHK Capital, and Jack Sun, CEO of AGBI. Their insights were both enriching and motivating, shedding light on emerging opportunities and strategic considerations for investors.

The gathering sparked meaningful dialogue and strengthened professional relationships, setting an optimistic tone as we enter 2026. A heartfelt thank-you to everyone who contributed to making this event truly memorable!

A MESSAGE FROM IRENE

CLICK BELOW TO WATCH OUR EVENT VIDEO:

LAND OPPORTUNITY

Land Opportunity in Abilene, TX

Just minutes from I20, Dyess AFB, and the Lancium project, this pristine 91.040 acre tract is the perfect mix of cultivation and pasture. With county road access, multiple gates, and approximately 4,130 feet of frontage, it s easy to get to and offers flexibility for a variety of uses. The land features four tanks, three currently holding water along with abundant wildlife. Completely fenced with a brand new north boundary fence, this property is an ideal spot for a homesite, farm, ranchette, or recreational retreat, all while being close to Abilene conveniences.

Offered at $910,400.

Contact Irene for more information.

EB5 OPPORTUNITY

CMB Group 101 – Hillwood Venture

Group 101 is a Build-to-Suit industrial logistics development in the Detroit metro area, featuring a 2.1 million sq. ft. distribution center custom-designed for Stellantis. The project sits on a ~318-acre site with a modern cross-dock layout, ample trailer and auto parking, and ESFR fire protection.

It includes a 30-year ground lease with extension options and a 20-year sublease to Stellantis, providing long-term stability. Located in a High-Unemployment TEA, the project is estimated to create 2,287 qualified jobs, offering a strong job buffer.

In addition to the main facility, the project will feature a guard house, an outdoor water tank to service the facility, 522 parking spaces, 43 loading docks, and approximately 423,000 square feet of outdoor storage space.

With excellent access to I-94, I-275, and Detroit Metropolitan Airport, the site is well positioned for automotive supply-chain operations. Total project cost is approximately $306 million.

CMB Group 101 – Investment Highlights:

EB-5 Loan Amount:Up to $79.2 million

Total Project Spending:~$305.9 million

Project Location:Meets USCIS requirements for a Targeted Employment Area (TEA), making investors eligible for the reduced investment threshold.

Estimated Job Creation:2,287 (~131% Job Creation Buffer)