CLI Newsletter September,2025

MARKET INSIGHT

Texas Multifamily Mid-Year Review

Article Source: Cushman and Wakefield

Despite high interest rates and supply pressures, Texas’ multifamily sector remains resilient halfway through 2025. Investors are finding opportunity in a market defined by affordability, population growth, and strong rental demand.

The rent vs. buy gap continues to drive leasing activity. In Dallas-Fort Worth, owning a home costs roughly $1,600 more per month than renting — a trend mirrored in Austin, Houston, and San Antonio. This affordability advantage ensures steady apartment demand.

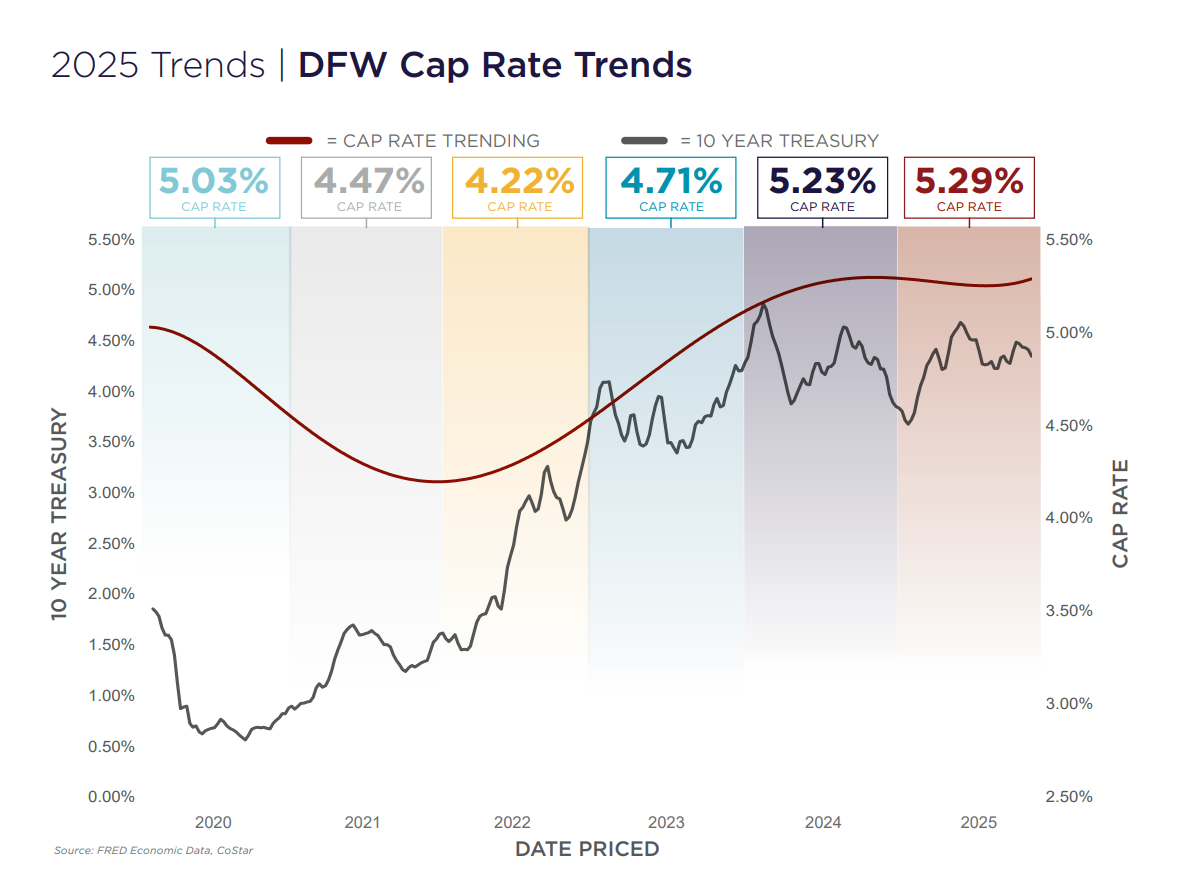

At the same time, cap rates have stabilized around 5%, providing a healthier long-term investment environment. While Dallas and Fort Worth absorbed a wave of new deliveries with some short-term softness, slower construction and strong job growth are helping conditions balance out.

Looking forward, rent growth prospects are robust: nearly 17% in Dallas-Fort Worth, 16% in Austin, and 15% in Houston over the next five years. Combined with surging replacement costs that boost the value of existing assets, Texas multifamily continues to stand out as one of the most attractive investment plays nationwide.

IN THE NEWS

Nvidia Partner Wistron Confirms $761M Fort Worth Supercomputer Plants

Article Source: Dallas Business Journal

Wistron Corp., a Taiwanese tech giant and key partner of Nvidia, has officially confirmed plans for two supercomputer factories in Fort Worth — a project valued at more than $761 million and expected to create nearly 900 jobs.

The company’s U.S. subsidiary has been quietly acquiring land and negotiating tax incentives in recent months to support Nvidia’s $500 billion AI infrastructure initiative. Wistron purchased two sites — including the 767,000-square-foot Westport 14 at AllianceTexas and the 325,000-square-foot 35 Eagle facility — which will serve as the base for assembling Nvidia-powered supercomputers.

Both sites are slated to open in early 2026, with the larger 35 Eagle property designated as the primary location. Investments include property upgrades, advanced equipment, and workforce expansion to support the booming AI ecosystem.

“Establishing manufacturing operations in the U.S. is a critical step in advancing our global vision,” said Jackie Lai, Wistron’s senior vice president. Fort Worth leaders, including Ross Perot Jr., emphasized the project’s role in America’s reshoring movement and AllianceTexas’ growing industrial ecosystem.

OUR RESEARCH

From China to Texas

Overview of Chinese Companies Investing, Operating, and Building in the Lone Star State

Presented by: CLI Investment Management

Texas, now a $2.7 trillion economy, has become one of the top U.S. destinations for Chinese companies. From energy and technology to finance and real estate, nearly 100 Chinese enterprises are investing, building, and creating thousands of local jobs.

Flagship projects include Trina Solar’s $200M, 1,500-job solar plant in Wilmer and Hithium’s large-scale energy storage site in Mesquite. Financial giants like ICBC and Bank of China operate in Houston, while Yum China runs its U.S. headquarters from Plano.

These moves highlight how Chinese firms are localizing production, tapping Texas’ workforce, and integrating into America’s fastest-growing economy.

CONSTRUCTION UPDATE

Wolf Creek Farms

We are excited to share the first five leases at Wolf Creek Farms, NHK Capital Partners’ ninth investment opportunity, have recently been executed — a major milestone as we approach initial unit delivery.

A gated, 343-unit Build-to-Rent community in Melissa, Texas, Wolf Creek Farms broke ground in spring 2024 and is currently ramping up for first unit delivery.

EB5 OPPORTUNITY

Group 97

Stillwater Travis South

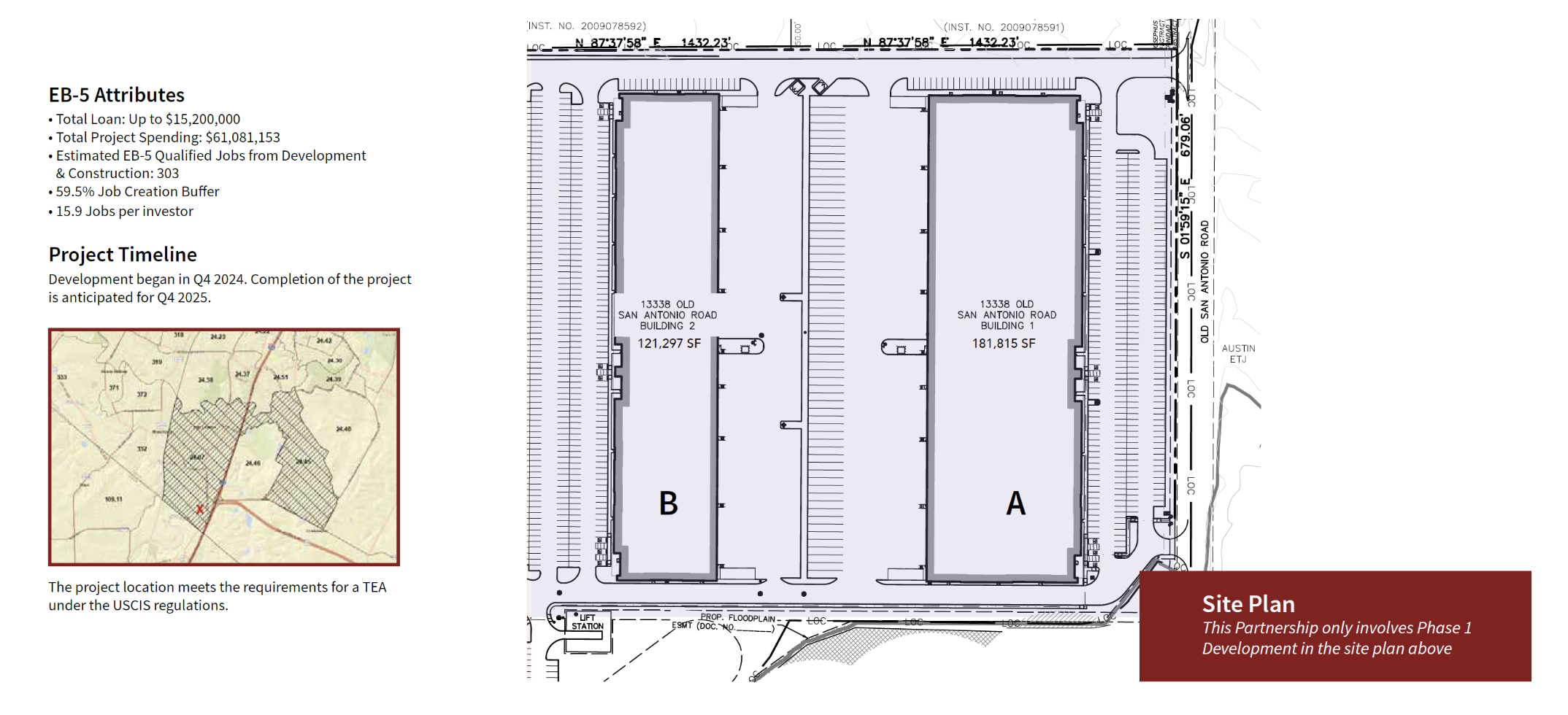

This project is strategically located in Austin, Texas, Just 10 minutes’ drive from downtown, 20 miles from Tesla’s Gina factory Texas and 33 miles from the Samsung semiconductor plant – this opportunity represents an ideal location for logistics, light manufacturing, and supply chain.

The Travis South (The project) – a two-phase, Class A industrial development featuring four buildings, totaling 576,061 square feet. Construction is progressing on schedule, Grading efforts have commenced, officially marking the start of site development.

The Travis South project is now closed to new investors. We are excited about the progress and eager to see this development continue to take shape.

And now we are pleased to announce that CMB Group 97 – Stillwater Travis South has received Form I-956F approval from USCIS, confirming that the project meets all EB-5 program requirements. This approval makes Group 97 investors eligible for immediate adjudication of their conditional green card (I-526E) petitions.

If you would like to learn more about this project, please reach out to Irene Shen directly.