CLI Newsletter January,2026

MARKET INSIGHT

U.S. Real Estate Market Outlook 2026

Presented by: CBRE

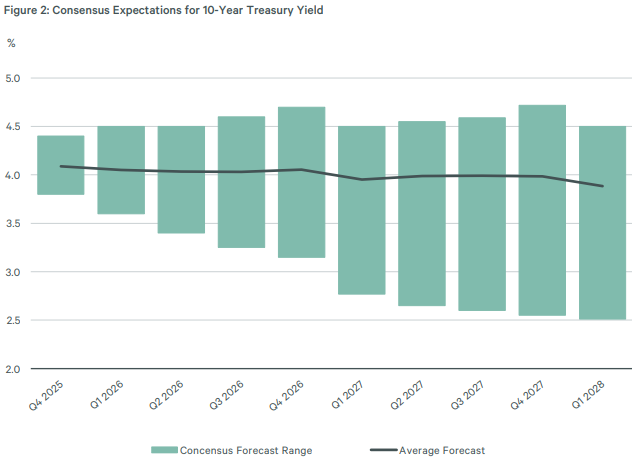

CBRE forecasts that annual U.S. GDP growth will slow to 2.0% in 2026 with softening labor market conditions and marginally lower inflation averaging 2.5%.

Despite these challenges, commercial real estate investment activity is expected to increase by 16% in 2026 to $562 billion, nearly matching the pre-pandemic (2015-2019) annual average. Total returns will be income driven. Asset selection and management will be key drivers for returns. Cap rates for most property types are expected to compress by 5 to 15 basis points (bps).

Commercial real estate leasing activity will continue to recover in 2026 from its 2024 low. The underlying performance and timing of recovery varies across sectors, asset types and markets.

Key Takeaways

Income is king in 2026. Returns will be driven more by cash flow than cap-rate expansion—buy quality and manage actively.

Quality wins across sectors. Prime office, modern industrial, grocery-anchored retail, and well-located assets will outperform.

Act early on scarce assets. Limited new supply means competition for top-tier space will intensify.

Data centers are the growth engine. AI demand + power constraints create premium pricing and long-term value, especially in deregulated, energy-rich markets.

Sun Belt ≠ uniform. Multifamily faces near-term headwinds in high-supply markets, but long-term migration and job growth remain intact.

Volatility creates opportunity. With sellers more realistic and capital abundant, 2026 offers a window to redeploy into mispriced, high-quality assets.

Look beyond headlines. Despite macro uncertainty, fundamentals support a broad CRE recovery—disciplined investors will be rewarded.

Chapters

Overview Chapter 1 Economy Chapter 2 Capital Markets Chapter 3 Office

Chapter 4 Industrial Chapter 5 Retail Chapter 6 Multifamily Chapter 7 Data Centers

Chapter 8 Healthcare Chapter 9 Life Sciences Chapter 10 Local Markets

IN THE NEWS

Housing took center stage in federal, state policy in 2025. In 2026, it’s ready for an encore

Experts see more zoning reform, modular building as keys to building supply

Presented by homes.com

Housing became a central political issue in 2025, and 2026 will focus on turning that momentum into real supply. Texas has emerged as a national leader, passing laws that curb local resistance, ease zoning constraints, and make it easier to build denser housing. Its approach—prioritizing growth and state-level action over local blockades—has become a model for other states now preparing similar reforms.

Alongside zoning changes, technical updates such as allowing taller buildings with a single staircase and growing support for modular construction aim to lower costs and speed development. Federal lawmakers are moving in the same direction by cutting red tape and modernizing housing programs, while Texas also explores giving voters more control over property taxes. Together, these shifts point to 2026 as a year that locks in a supply-first housing framework, with Texas leading the way.

2026 TEXAS RETAIL MARKET REPORT

Presented by Weitzman

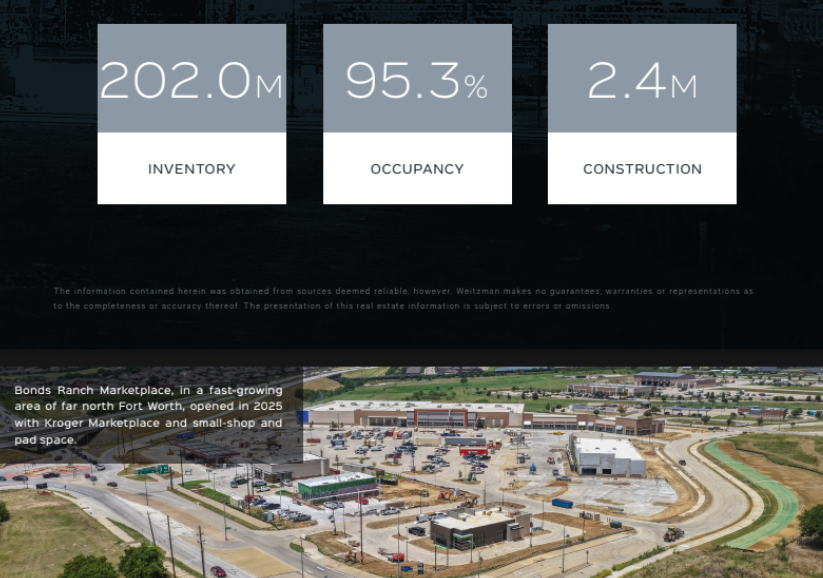

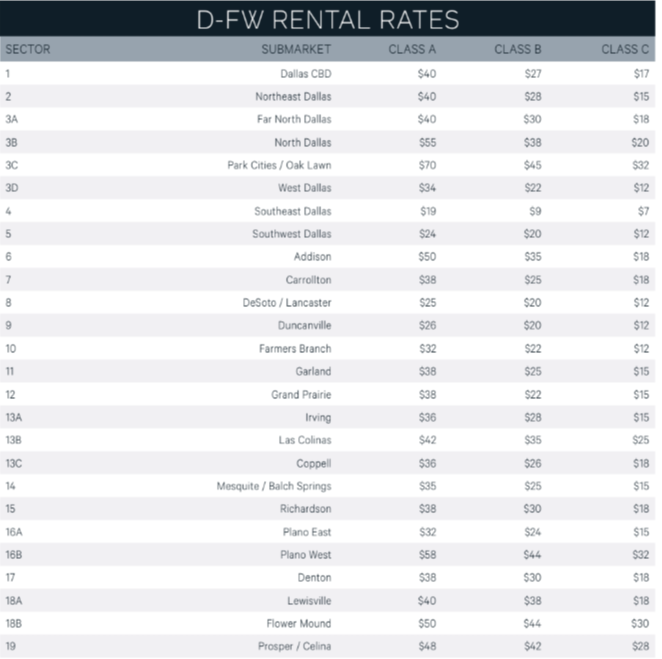

Retail has become the standout performer in the DFW commercial landscape. As we enter 2026, the momentum from last year is transforming into a "supply-disciplined" boom. With an occupancy rate of 95.3%, Dallas-Fort Worth has emerged as a national leader in retail resilience, defying broader economic headwinds through strategic growth and rapid population expansion.

DFW is currently the most active grocery market in the nation, with 34 new projects underway to serve the booming "rooftops" in Collin and Denton Counties. From the expansion of H-E-B to the rise of experience-based service retail, the region’s approach—prioritizing essential, community-focused hubs—has become the gold standard for commercial stability. Together, these shifts point to 2026 as the year that locks in DFW's position as the premier retail investment destination in the U.S.

UPCOMING OPPORTUNITY

The Edge at Seabrook

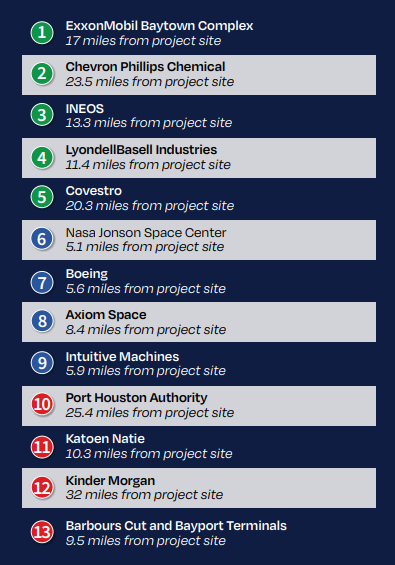

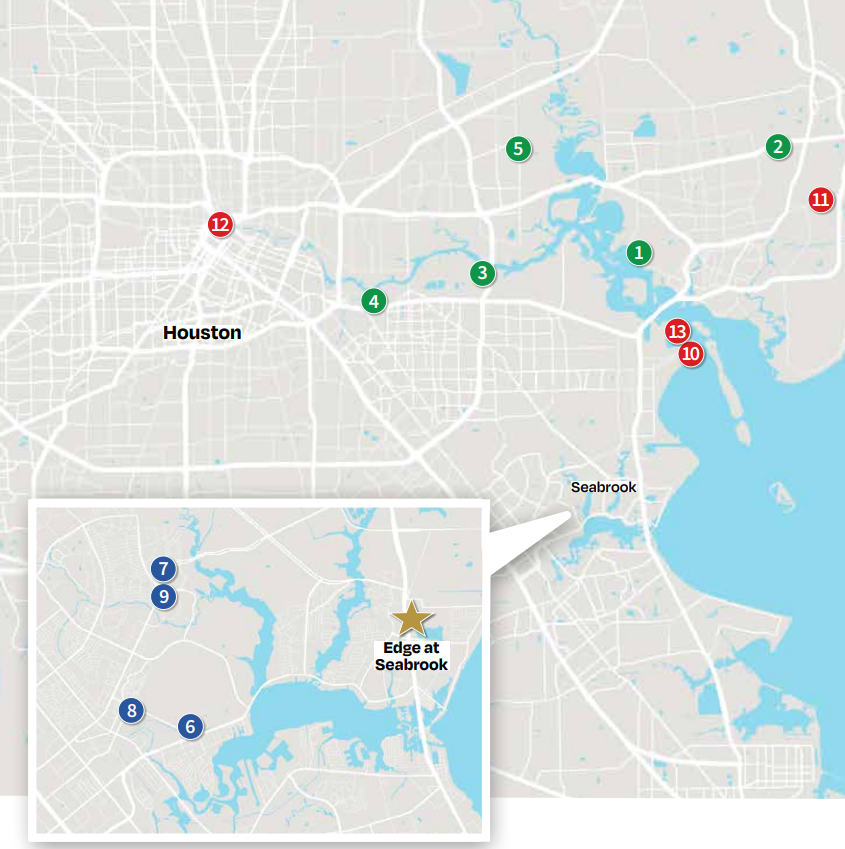

The Edge at Seabrook, another upcoming investment opportunity from NHK, a premier Class-A garden multifamily development located within the Seabrook Towne Center mixed-use community.

This investment will fund the development and construction of a ~289,000 SF community with 320 units, anchored by nearby retail, restaurants, and lifestyle amenities. Residents will enjoy two resort-style pools, a clubhouse, pickleball courts, two fitness centers, and garage parking — all within walking distance of the Seabrook Town Centre.

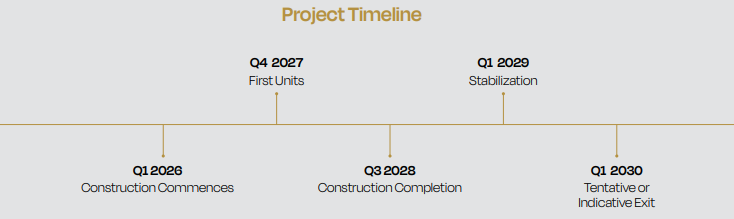

Construction is expected to commence in Q1 2026, with an anticipated exit in Q1 2030.

NHK will be hosting an investor webinar on January 21 to dive deeper into this opportunity. Spots are limited—click the link below to register today.